Transocean Ltd (RIG)

6.5550

+0.1650 (2.58%)

NYSE · Last Trade: Feb 24th, 10:49 AM EST

The U.S. Department of Commerce released a sobering report today, February 20, 2026, revealing that the American economy slowed to a crawl in the final months of 2025. According to the Bureau of Economic Analysis (BEA), Real Gross Domestic Product (GDP) increased at an annual rate of 1.4%

Via MarketMinute · February 20, 2026

Transocean (RIG) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 20, 2026

As of February 20, 2026, the offshore drilling industry is witnessing a tectonic shift, and at its epicenter stands Transocean Ltd. (NYSE: RIG). After a decade defined by brutal restructuring and a fight for survival following the 2014 oil collapse, Transocean has re-emerged not just as a survivor, but as a consolidator. The company’s recent [...]

Via Finterra · February 20, 2026

Transocean, Valaris To Form $17 Billion Offshore Drilling Firm – VAL Stock Jumps 13%, RIG Slumps 6% In Pre-Marketstocktwits.com

Via Stocktwits · February 9, 2026

Transocean Ltd. (NYSE: RIG) reported mixed Q4 2025 results, with adjusted EPS of $0.02 missing estimates of $0.08.

Via Benzinga · February 20, 2026

he Valaris acquisition will enable Transocean to own 73 rigs capable of serving customers in deepwater, harsh-environment, and shallow-water basins around the world.

Via Stocktwits · February 19, 2026

Caution over the Valaris deal drives a pullback for this offshore driller today, Feb. 17, 2026.

Via The Motley Fool · February 17, 2026

The company moved in sync with the business it's soon to combine with.

Via The Motley Fool · February 17, 2026

These stocks are making the most noise in today's session.chartmill.com

Via Chartmill · February 17, 2026

Discover the most active stocks in Friday's session.chartmill.com

Via Chartmill · February 13, 2026

Valaris agreed to be acquired by rival Transocean, creating the largest offshore oil rig company in the public markets.

Via The Motley Fool · February 13, 2026

Transocean’s planned Valaris acquisition and expanding contract backlog are reframing its long-term earnings outlook.

Via The Motley Fool · February 12, 2026

Curious about the most active stocks on Thursday?chartmill.com

Via Chartmill · February 12, 2026

Curious about the most active stocks on Wednesday?chartmill.com

Via Chartmill · February 11, 2026

These stocks are making the most noise in today's session.chartmill.com

Via Chartmill · February 10, 2026

The oil and gas services industry is consolidating.

Via The Motley Fool · February 9, 2026

On Feb. 9, 2026, offshore drilling’s scale and backlog are being reshaped by a $5.8 billion all-stock merger.

Via The Motley Fool · February 9, 2026

Which stocks are most active on Monday?chartmill.com

Via Chartmill · February 9, 2026

Via MarketBeat · February 8, 2026

MELBOURNE, Australia — As the curtain closes on 2025, Transocean Ltd. (NYSE:RIG) has solidified its position as the undisputed titan of the offshore drilling world, propelled by a highly successful and strategically vital drilling campaign in Australian waters. The company’s stock, which faced significant headwinds earlier in the decade,

Via MarketMinute · December 31, 2025

Transocean (RIG) Q1 2025 Earnings Call Transcript

Via The Motley Fool · December 23, 2025

Transocean (RIG) Q3 2025 Earnings Call Transcript

Via The Motley Fool · December 23, 2025

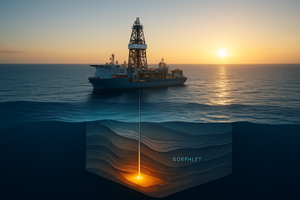

In a landmark announcement on December 22, 2025, energy giants Shell and INEOS Energy revealed a significant oil discovery at the Nashville exploration well, situated in the deepwater Norphlet play of the U.S. Gulf of Mexico—a region now increasingly referred to by industry and government officials as the

Via MarketMinute · December 22, 2025

Offshore drilling specialist Transocean reported a notable insider sale amid ongoing industry volatility and a year of modest share gains.

Via The Motley Fool · December 19, 2025