As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at specialty retail stocks, starting with Best Buy (NYSE:BBY).

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

The 9 specialty retail stocks we track reported a satisfactory Q1. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Luckily, specialty retail stocks have performed well with share prices up 14.3% on average since the latest earnings results.

Best Buy (NYSE:BBY)

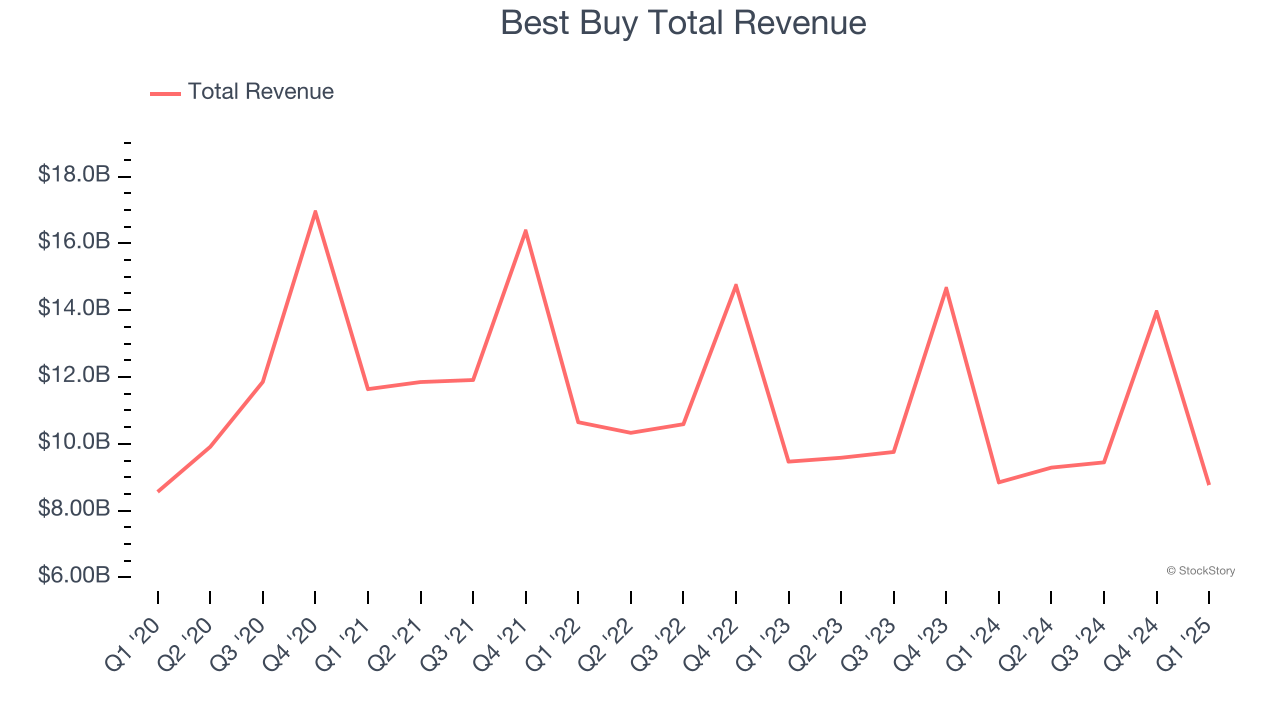

With humble beginnings as a stereo equipment seller, Best Buy (NYSE:BBY) now sells a broad selection of consumer electronics, appliances, and home office products.

Best Buy reported revenues of $8.77 billion, flat year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ EBITDA estimates.

Best Buy achieved the highest full-year guidance raise of the whole group. Even though it had a relatively good quarter, the market seems discontent with the results. The stock is down 45.3% since reporting and currently trades at $66.90.

Is now the time to buy Best Buy? Access our full analysis of the earnings results here, it’s free.

Best Q1: Sportsman's Warehouse (NASDAQ:SPWH)

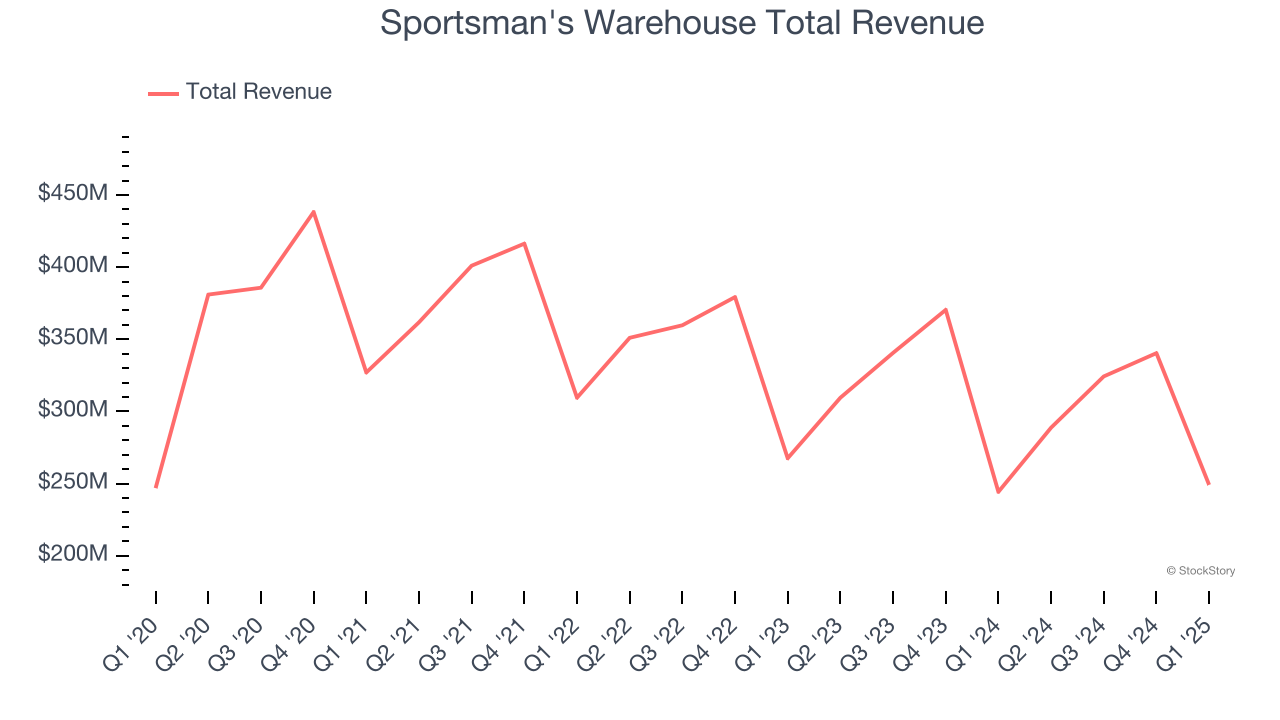

A go-to destination for individuals passionate about hunting, fishing, camping, hiking, shooting sports, and more, Sportsman's Warehouse (NASDAQ:SPWH) is an American specialty retailer offering a diverse range of active gear, equipment, and apparel.

Sportsman's Warehouse reported revenues of $249.1 million, up 2% year on year, outperforming analysts’ expectations by 4.6%. The business had a stunning quarter with a solid beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

Sportsman's Warehouse scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 45.3% since reporting. It currently trades at $3.40.

Is now the time to buy Sportsman's Warehouse? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Academy Sports (NASDAQ:ASO)

Founded in 1938 as a tire shop before expanding into fishing equipment, Academy Sports & Outdoor (NASDAQ:ASO) sells a broad selection of sporting goods but is still known for its outdoor activity merchandise.

Academy Sports reported revenues of $1.35 billion, flat year on year, falling short of analysts’ expectations by 1.5%. It was a softer quarter as it posted a significant miss of analysts’ EBITDA estimates and a miss of analysts’ EPS estimates.

Interestingly, the stock is up 16.1% since the results and currently trades at $51.59.

Read our full analysis of Academy Sports’s results here.

Warby Parker (NYSE:WRBY)

Founded in 2010, Warby Parker (NYSE:WRBY) designs, manufactures, and sells eyewear, including prescription glasses, sunglasses, and contact lenses, through its e-commerce platform and physical retail locations.

Warby Parker reported revenues of $223.8 million, up 11.9% year on year. This number missed analysts’ expectations by 0.8%. More broadly, it was actually a strong quarter as it put up an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Warby Parker achieved the fastest revenue growth among its peers. The stock is up 43.1% since reporting and currently trades at $23.09.

Read our full, actionable report on Warby Parker here, it’s free.

Sally Beauty (NYSE:SBH)

Catering to both everyday consumers as well as salon professionals, Sally Beauty (NYSE:SBH) is a retailer that sells salon-quality beauty products such as makeup and haircare products.

Sally Beauty reported revenues of $883.1 million, down 2.8% year on year. This print came in 2% below analysts' expectations. All in all, it was a mixed quarter for the company.

The stock is up 20.7% since reporting and currently trades at $9.87.

Read our full, actionable report on Sally Beauty here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.